What does “Brexit” Mean for US Mortgage Rates?

You’ve probably heard about Britain’s momentous decision to leave the European Union by now, but have you thought about how this might affect your mortgage? Well if you haven’t, you should.

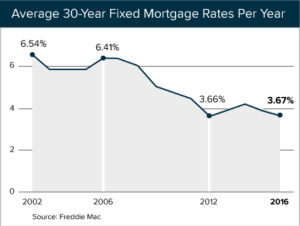

With Britain’s vote for economic independence, and the instability of global stock markets, the 10 Year Treasury Bond rate plummeted on Friday – and that trend has continued today, for more information click here. What does this mean for mortgage rates? Basically, when bond prices rise, yields go down, which means that lenders have the opportunity to move their rates even lower. Despite the expectation that mortgage rates would rise this year, the Brexit vote could cause them to continue to fall even further.

“At this point, it is unclear whether this will just be a short term disruption, or whether it will have a longer-term impact,” reported Mortgage Banker Association’s chief economist, Michael Fratantoni. “Our best guess at this point is that the impact on the mortgage market will be to keep mortgage rates lower for longer, likely leading to another pickup in refinance activity.”

Whether you are a current home owner or are in the market to purchase a new home, now is one of the best times in history to refinance your current mortgage or to purchase your dream home.

What are some other ways Brexit could affect you?

Retirement – The morning after Britain voted out, the Dow dropped more than 500 points. Despite this dip, financial experts advise investors not to panic. Since most retirement plans are long-term investments they advise leaving your funds in place until the market recovers. The retirement plan real estate market doesn’t seem affected though, the Active Adult Community Home Listings have always been high in the market range and will most likely stay there because they are nearly isolated from the normal home listing market, since a very specific group of people are the ones that look for them. However, this may be a good time to review your portfolio and make sure it’s set up in a way to help meet your goals over the long-haul. Consult your personal financial planner for more information on how best to act!

Your Summer Vacation – Planning a trip to London or another city in the U.K.? The British pound fell 8% overnight after Britain voted to leave the EU, making it the currency’s single worst day on record! In relation to the US dollar, the exchange rate is the best it’s been since 1985. If the pound stays low against the dollar, American consumers could have a lot more buying power and find their cash going a long way across the pond.

This sort of huge market movement almost always results in widely varied pricing strategies among lenders so we encourage you to contact us for a no-obligation discussion and complementary rate quote.

Have some more mortgage related questions? Contact Rosella!

direct 617-266-3999 x327 fax 617-830-0837

671 Tremont St., Boston, Massachusetts 02118

RCampion@mortgagemaster.com | www.mortgagemaster.com/