To buy or to rent in Boston? That is the question!

I have noticed a new trend with clients that I meet for buying consultations. The majority of these clients are potential first time home buyers trying to determine whether to buy or to rent in Boston. More and more frequently, they are choosing to move out of the rental market and into the home or condo for sale market in Boston by purchasing their first home.

I have noticed a new trend with clients that I meet for buying consultations. The majority of these clients are potential first time home buyers trying to determine whether to buy or to rent in Boston. More and more frequently, they are choosing to move out of the rental market and into the home or condo for sale market in Boston by purchasing their first home.

Why?

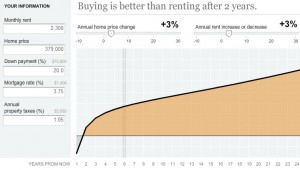

For most of these buyers who want to remain in Boston it is simply more cost effective! Hard to believe but the rent vs buy dynamic in the Boston real estate market is changing. Sale prices have moderated in some areas, but rental rates have been climbing for almost 2 years. Rents in the Boston area hit record highs in the last quarter of 2011.

While some people have chosen to stay in apartments by choice, others have been forced to rent because of unemployment or uncertainty about their job status. If you are uncertain about your job status or unemployment, renting is clearly still the best option. But if job stability and personal preferences align, then buying may now be a better option because of what’s happening in the Boston rental market.

Rents have risen so fast because there has been a lack of new construction in the past several years, even though more people were looking to rent. Finally developers are seeing the opportunity are stepping up the apartment construction but it still may not be enough to slow rent growth. Within Boston, developers broke ground for 1912 housing units last year with 418 of the units being affordable housing. However, the rental shortage will continue for a quite a while as the new construction is still not enough to keep up with the need for housing.

At the same time, mortgage rates are now at an all-time low and for sale home and condo prices have stabilized, and even begun to increase in some areas of Boston.

According to Ravi Pahuja of Residential Mortgage Services (as of 1/27/2012) assuming good credit, mortgage rates are 3.75% for a 30 Year Fixed loan (and as low as 2.75% for a 5/1 ARM rate, which can a great option for some buyers).

Using the 30 Year Fixed mortgage rate of 3.75%, here’s a quick example of the math (using a real condo for sale in Brookline) to help decide whether to buy or to rent in the Boston area, a specific property:

I recently showed 1407 Beacon Street in Brookline with a listing price of $389,000. It is currently rented at $2300.

If you paid full price at $389,000 with 20% down your loan amount would be $311,200.

$311,200 at an interest rate of 3.75% breaks down to a monthly payment of $1443.

Principal and Interest payment: $1441 per month

Condo fee: $495 per month (includes heat and hot water)

Taxes: $3991 per year, or $333 per month

S0…..

$1441 + $495+$333= $2269 per month to buy vs. $2300 per month to rent

Without even taking into account potential tax savings (or lower rates from an ARM mortgage if you were only going to be in the home for 5-7 years), it still is cheaper to buy than to rent the same property. This example is becoming more and more typical of a Boston area rent vs buy calculation. Not only are you paying less but you are also building equity and now have some tax write-offs associated with a purchase. And you have control over the property, can make changes, and not worry about having your rental apartment sold from under you (or other similar inconveniences) – to name a few other benefits.

Of course, that example is a simple top level calculation to help guide your decision to rent vs buy in Boston. As you can imagine, a whole lot more details can and should factor into your decision to rent or to buy a home in Boston. To help with your decision I am available to schedule a home buying consultation to determine which option works best for you.